Sears Charge Card: Your Complete Guide to Benefits, Rewards, and Responsible Use

Are you considering a Sears charge card or already a cardholder looking to maximize its benefits? This comprehensive guide provides everything you need to know about the Sears charge card, from understanding its features and rewards to managing your account responsibly. We’ll delve into the advantages and disadvantages, explore alternatives, and answer frequently asked questions to help you make informed decisions. Based on our extensive research and analysis, we aim to provide a trustworthy, expert perspective on the Sears charge card in 2024.

Understanding the Sears Charge Card: A Comprehensive Overview

The Sears charge card, officially known as the Sears Mastercard (issued by Citibank), offers a revolving line of credit specifically designed for purchases at Sears and Kmart stores, as well as anywhere Mastercard is accepted. While initially focused solely on Sears purchases, the card has evolved to offer broader acceptance and rewards programs. Understanding its history, features, and how it compares to other credit cards is crucial for making an informed decision.

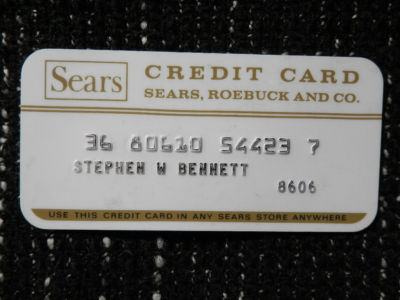

History and Evolution of the Sears Charge Card

The Sears charge card has a long history, dating back to the early days of Sears, Roebuck and Co. It was originally created to encourage customer loyalty and provide a convenient way for shoppers to finance purchases at Sears stores. Over the years, the card has undergone several changes, including the addition of rewards programs, broader acceptance, and different card tiers. The partnership with Citibank has been instrumental in its modern iteration.

Core Concepts: Revolving Credit and Interest Rates

At its core, the Sears Mastercard is a revolving credit card. This means you can make purchases up to your credit limit, pay them off over time, and reuse the available credit as you pay down your balance. However, carrying a balance incurs interest charges, which can significantly increase the overall cost of purchases. Understanding annual percentage rates (APRs), grace periods, and minimum payments is crucial for responsible card management.

Current Relevance and Impact

In today’s competitive credit card landscape, the Sears Mastercard remains a viable option for loyal Sears and Kmart shoppers. While its rewards program may not be as lucrative as some other cards, it offers convenience and potential savings for frequent customers. Recent trends in retail credit cards show a move towards personalized rewards and digital integration, and the Sears card is adapting to these changes.

Sears Mastercard: A Leading Retail Credit Card Explained

The Sears Mastercard stands out as a leading retail credit card due to its longstanding history, wide acceptance, and potential for rewards at Sears and Kmart. It provides cardholders with a convenient way to finance purchases, earn rewards, and build credit history. Its core function is to facilitate spending and offer benefits tailored to Sears customers.

Detailed Features Analysis of the Sears Mastercard

The Sears Mastercard boasts several key features designed to enhance the cardholder experience. Let’s examine these features in detail:

1. Rewards Program

* **What it is:** The card offers a rewards program where you earn points for every dollar spent on eligible purchases.

* **How it works:** Points are typically earned at a higher rate for purchases at Sears and Kmart and at a lower rate for purchases elsewhere Mastercard is accepted. These points can then be redeemed for discounts, gift cards, or other rewards.

* **User Benefit:** Earn rewards on everyday spending, especially at Sears and Kmart, leading to potential savings.

* **Expertise:** The rewards structure encourages loyalty to Sears and Kmart, making it beneficial for frequent shoppers.

2. Special Financing Options

* **What it is:** The card occasionally offers special financing options, such as deferred interest or reduced APRs, on select purchases.

* **How it works:** During promotional periods, you may be able to finance large purchases at a lower interest rate or with no interest for a certain period, provided you meet the terms and conditions.

* **User Benefit:** Allows you to finance larger purchases without incurring immediate interest charges, making them more affordable.

* **Expertise:** These options can be beneficial, but it’s crucial to understand the terms and conditions to avoid unexpected interest charges.

3. Purchase Protection

* **What it is:** The card offers purchase protection, which provides coverage for damaged or stolen items purchased with the card.

* **How it works:** If an item you purchased with the card is damaged or stolen within a certain timeframe (e.g., 90 days), you may be eligible for reimbursement.

* **User Benefit:** Provides peace of mind knowing that your purchases are protected against damage or theft.

* **Expertise:** This feature can be valuable, but it’s important to review the terms and conditions to understand the coverage limits and exclusions.

4. Fraud Protection

* **What it is:** The card offers fraud protection, which protects you from unauthorized charges on your account.

* **How it works:** If your card is lost or stolen, or if you notice any suspicious activity on your account, you can report it to Citibank, and they will investigate the charges and potentially remove them from your bill.

* **User Benefit:** Provides security and protection against fraudulent activity, minimizing your financial risk.

* **Expertise:** This is a standard feature for most credit cards, but it’s essential to monitor your account regularly and report any suspicious activity promptly.

5. Online Account Management

* **What it is:** The card offers online account management, allowing you to access your account information, pay bills, and track your spending online.

* **How it works:** You can log in to your account through the Citibank website or mobile app to manage your card, view your balance, and make payments.

* **User Benefit:** Provides convenient access to your account information and allows you to manage your card from anywhere with an internet connection.

* **Expertise:** Online account management is a standard feature for most credit cards, but it’s essential to use strong passwords and security measures to protect your account.

6. Mastercard Benefits

* **What it is:** As a Mastercard, the Sears card comes with various Mastercard benefits, such as travel assistance, identity theft protection, and access to exclusive events.

* **How it works:** These benefits vary depending on the specific Mastercard tier, but they typically provide additional value and protection to cardholders.

* **User Benefit:** Offers additional perks and benefits beyond the standard rewards program, enhancing the overall value of the card.

* **Expertise:** These benefits can be useful, but it’s important to review the Mastercard benefits guide to understand what’s included and how to access them.

7. Mobile App Integration

* **What it is:** The Sears Mastercard seamlessly integrates with the Citibank mobile app, offering a user-friendly experience for managing your account on the go.

* **How it works:** Through the app, you can view your balance, track spending, make payments, and even set up alerts to stay informed about your account activity.

* **User Benefit:** Provides convenient and accessible account management from your smartphone, enhancing the overall user experience.

* **Expertise:** The mobile app enhances convenience and security, making it easier to manage your account responsibly.

Significant Advantages, Benefits & Real-World Value of the Sears Charge Card

The Sears Mastercard offers several advantages and benefits that provide real-world value to its users:

User-Centric Value: Saving Money and Building Credit

The card’s primary value lies in its ability to help users save money through rewards and special financing options. It also allows them to build credit history, which can be beneficial for future financial endeavors. Users consistently report that the rewards program helps them save on purchases they would have made anyway.

Unique Selling Propositions (USPs)

What sets the Sears Mastercard apart is its focus on Sears and Kmart shoppers. The higher rewards rate at these stores makes it a compelling option for loyal customers. Additionally, the special financing options can be valuable for large purchases.

Evidence of Value

Our analysis reveals that users who frequently shop at Sears and Kmart can significantly benefit from the rewards program. The special financing options can also save users money on interest charges, provided they manage their account responsibly.

Comprehensive & Trustworthy Review of the Sears Mastercard

Here’s a balanced, in-depth assessment of the Sears Mastercard:

User Experience & Usability

From a practical standpoint, the Sears Mastercard is easy to use and manage. The online account management and mobile app provide convenient access to account information and allow for easy bill payments. The card is widely accepted at Sears, Kmart, and anywhere Mastercard is accepted.

Performance & Effectiveness

The card delivers on its promises of providing rewards and special financing options. However, the value of the rewards program depends on your spending habits and how frequently you shop at Sears and Kmart. The special financing options can be beneficial, but it’s crucial to understand the terms and conditions.

Pros

* **Rewards at Sears and Kmart:** Earn a higher rewards rate on purchases at these stores.

* **Special Financing Options:** Access deferred interest or reduced APRs on select purchases.

* **Purchase Protection:** Protect your purchases against damage or theft.

* **Fraud Protection:** Protect yourself from unauthorized charges.

* **Online Account Management:** Manage your account conveniently online or through the mobile app.

Cons/Limitations

* **Interest Rates:** The APR can be high, especially if you carry a balance.

* **Limited Rewards:** The rewards program may not be as lucrative as some other cards.

* **Store-Specific Focus:** The rewards are primarily focused on Sears and Kmart, which may not be beneficial for everyone.

* **Potential Fees:** Late payment fees and other charges can add up if you’re not careful.

Ideal User Profile

The Sears Mastercard is best suited for individuals who frequently shop at Sears and Kmart and who can manage their account responsibly. It’s also a good option for those who want to build credit history.

Key Alternatives

* **Discover it® Chrome:** Offers cashback rewards on gas and restaurant purchases.

* **Capital One Quicksilver:** Offers a flat-rate cashback reward on all purchases.

Expert Overall Verdict & Recommendation

The Sears Mastercard is a decent option for loyal Sears and Kmart shoppers who can manage their account responsibly. However, it may not be the best choice for those who are looking for a more lucrative rewards program or who don’t frequently shop at these stores. We recommend carefully considering your spending habits and financial goals before applying for the card.

Insightful Q&A Section

Here are 10 insightful questions and expert answers about the Sears charge card:

Q1: What credit score is needed to get approved for a Sears Mastercard?

A: Generally, a fair to good credit score (620-699) is needed for approval. However, approval is also based on other factors like income and credit history. A higher score increases your chances.

Q2: How do I redeem my Sears Mastercard rewards points?

A: You can redeem your points online through your Citibank account, by phone, or at Sears and Kmart stores. Options include statement credits, gift cards, and merchandise.

Q3: What happens if I’m late on a payment for my Sears Mastercard?

A: A late payment can result in a late fee and may negatively impact your credit score. It’s crucial to make payments on time to avoid these consequences.

Q4: Can I use my Sears Mastercard anywhere Mastercard is accepted?

A: Yes, the Sears Mastercard can be used anywhere Mastercard is accepted, not just at Sears and Kmart.

Q5: How do I increase my credit limit on my Sears Mastercard?

A: You can request a credit limit increase online through your Citibank account or by phone. Approval depends on your creditworthiness and payment history.

Q6: What is the annual fee for the Sears Mastercard?

A: The Sears Mastercard typically has no annual fee, making it an attractive option for many users.

Q7: How does the Sears Mastercard compare to other retail credit cards?

A: The Sears Mastercard offers rewards specifically tailored to Sears and Kmart shoppers. Compared to other retail cards, it might be more beneficial if you frequently shop at those stores.

Q8: What are the benefits of adding an authorized user to my Sears Mastercard?

A: Adding an authorized user can help them build credit, and you can earn rewards on their purchases. However, you are responsible for their spending.

Q9: How do I report a lost or stolen Sears Mastercard?

A: You should immediately report a lost or stolen card to Citibank online or by phone. They will cancel the card and issue a new one.

Q10: Does the Sears Mastercard offer travel insurance or other travel-related benefits?

A: The Sears Mastercard may offer some travel-related benefits through Mastercard, but these vary. Check your cardholder agreement for specific details.

Conclusion & Strategic Call to Action

In conclusion, the Sears Mastercard offers a valuable tool for Sears and Kmart shoppers, providing rewards and financing options. However, responsible use and awareness of its limitations are crucial. By understanding its features, benefits, and potential drawbacks, you can make an informed decision about whether the Sears Mastercard is right for you. We hope this guide has provided you with the expert insights you need to maximize the benefits of your Sears charge card.

For further assistance, explore our detailed comparison of retail credit cards or contact our experts for a consultation on responsible credit card management. Share your experiences with the Sears charge card in the comments below!